Informational

Guides

Lorem ipsum dolor sit amet consect

What is Direct Indexing?

Investors may be interested in transferring from existing investments into a direct index. Direct indexing provides several benefits to investors. The primary benefits include Tax Loss Harvesting (TLH), hyper personalization, and risk mitigation.

Tax Loss Harvesting (TLH)

Direct indexing allows TLH to be done more frequently and in more market environments than mutual funds or ETFs.

Hyper Personalization

Because direct indexing is an investment strategy which allows the investor to hold individual stocks, select advisors, such as Morling Financial Advisors (MFA), can tailor a direct index around each investor’s values, rather than using a cookie cutter fund which may or may not accurately reflect the investor’s beliefs and values.

Risk Mitigation

If investors receive stock options or restricted stocks, they may have concentrated positions in the company’s stock. MFA leverages a direct indexing technology partnership to provide a more elegant option: exclude concentrated companies and build around the position to create a completion portfolio as opposed to buying an index fund that may further concentrate the position.

The Challenge of Transitioning to a Direct Index Strategy

How do investors implement direct indexing in their portfolios? In the most straightforward case, an investor would fund the direct index with cash, and Morling’s partner asset manager would purchase the individual stocks to create the direct index.

Most investors, however, don’t have a pile of cash sitting around. Instead, their money is already invested. If the investor owns stocks with a low cost basis, there may be a high cost associated with the transition to a direct index. Often, investors have owned a portfolio of index funds for a long period of time or have highly appreciated stock from employer IPOs. Because these assets have greatly increased in value, selling them to fund the direct index would result in paying a significant amount of taxes on the capital gains.

Common Solutions

How can you reap the benefits of a direct index while minimizing the fees associated with the transition? Investors have several options to transition over to a direct index.

Take the tax hit

In some cases, the investor may choose to simply pay the taxes upfront. This makes sense when the capital gains are not significantly high, or if the investor wants to align their finances with their values sooner than later.

Realize gains over time

If the investor already owns several individual stocks, it’s possible to create a direct index around the concentrated positions. As the direct index realizes tax losses, it can simultaneously realize tax gains so the investor will gradually transition to the direct index without paying taxes. However, this process may take years depending on the amount of capital gains in the SMA and the volatility of the market.

Donate the stock

Philanthropic-minded investors may choose to donate a portion of the stock to a nonprofit organization. These organizations would not pay capital gains taxes, so the investor would simultaneously fulfill their philanthropic goals and shrink the concentrated position, allowing the portfolio to be more balanced.

Opportunity Zones: A Different Approach

MFA offers a unique solution using opportunity zones. A key component of the 2017 Tax Cut and Jobs Act was the “opportunity zone” legislation, which was designed to encourage investment into specific geographic areas. Without summarizing the entire legislation, there were three general incentives for investors:

- If an investment is made into a Qualified Opportunity Fund (QOF) within 180 days after a capital gain is realized, tax on that gain may be deferred. The number of years of deferral depends on several factors.

- The capital gain is decreased as certain holding periods are achieved. Again, the specific holding periods and reduction of gains varies depending on several factors.

- The investment will not be subject to capital gains taxes.

Most QOFs are focused on real estate development or rehab. In our view, any investment (including QOFs) should be evaluated and made based on its own merits, rather than simply made for tax purposes. That said, we believe that QOFs are a very useful tool for investors and the tax benefits are complementary to those of direct indexing.

Scenarios

Investor with MF/ETF Gains

Consider an investor who bought $1,000,000 of mutual funds and ETFs several years ago. The portfolio has appreciated and is now worth $1,300,000. In order to transition the entire portfolio to direct indexing, the investor would have to realize $300,000 of capital gains. If we assume the gains are long-term and taxed a federal rate of 20%*, then the investor would owe $60,000 of tax and the resulting portfolio available for reinvestment into direct indexing would be $1,240,000.

However, if our investor wanted to allocate $300,000 to real estate, then they could:

- Realize the gains

- Invest in a QOF

- Defer the tax liability

- Receive a discount on the tax liability when it's due, and

- Avoid capital gains on the new investment forever

The resulting portfolio would be $1M in direct indexing and $300,000 in real estate.

Alternatively, an investor can use $300,000 of “new” cash to buy the real estate while still transitioning $1,300,000 to equities (for a total portfolio of $1.6M). Of course, there are endless other variations depending on investor risk tolerance, target asset allocation, and tax situation. For instance, the investor could realize 300,000 of gains and only invest 200,000 in an opportunity zone, in which case the current year tax liability would be $20,000 ($100,000 non-deferred gain at 20% tax rate) rather than $60,000.

*We will focus solely on federal tax benefits since state tax treatment of opportunity funds varies.

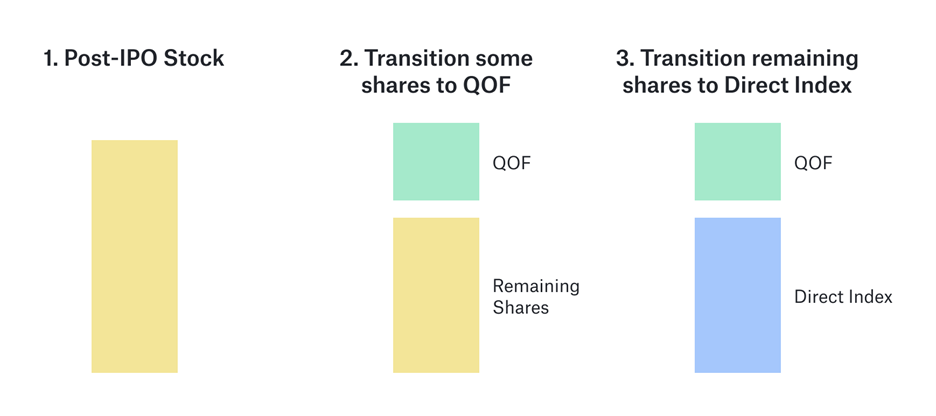

Investor with Concentrated Post-IPO Stock

Most of MFA’s clients are located in the San Francisco Bay Area and many clients have significant wealth in their employers’ stock. While most investors understand the need to diversify their concentrated position after an IPO, many are also hesitant to incur large tax liabilities (especially if the unrealized gains are classified as short-term). Yet, holding a concentrated position is clearly risky.

Consider an investor whose company IPO’d in March 2020. The investor is free to sell their stock in September 2020 after the standard six-month blackout period ends. The investor may have many lots from different years and sources, such as incentive stock options (ISO), non-qualified stock options (NQ), and RSUs. Tax-wise, it may be beneficial to sell some lots immediately, but to wait for other lots. The tax liability for lots sold in 2020 may be reduced by allocating to a QOF, while the investor may want to wait until January (a new tax year) or March (one-year from IPO) to sell other lots. Sales made earlier in a calendar year may also benefit if the proceeds are reinvested into a direct index portfolio, as losses can be harvested for more months in the calendar year.

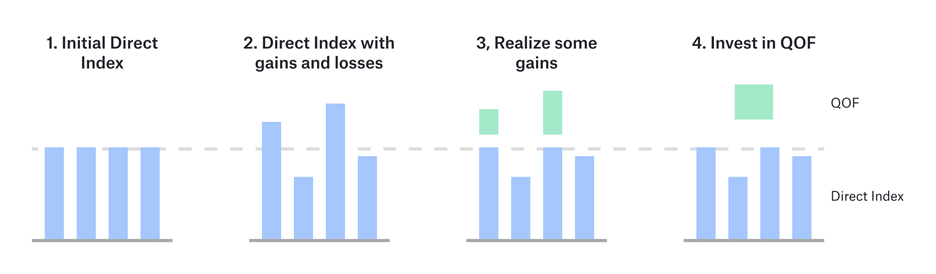

Investor with New Cash

One of the primary benefits of direct indexing is the ability to better plan for and manage taxes. Consider an investor who has cash to invest and identifies an attractive QOF opportunity that would fit well in their portfolio. In order to receive most of the tax benefits, the investor could realize gains and then fund the QOF. Even if the portfolio performance is negative, a direct indexed portfolio will contain some positions with gains. These positions could be sold to realize gains (and even immediately repurchased since the wash sale rule only applies to losses). This would allow the investor to maintain their equity market exposure and realize gains to make the most out of the QOF investment.

Are you considering direct indexing to optimize your portfolio? Connect with us to learn more about how our team can manage your wealth and set you up for success.

Resources:

How Do Opportunity Zones Work?, U.S. Department of Housing and Urban Development

Opportunity Zones FAQs, IRS website

What You Need to Know About Opportunity Zones, Morgan Simon, Forbes

Map of All Opportunity Zones, U.S. Department of Housing and Urban Development

Take Control of Your Financial Future

Work with our team of advisors to manage

your wealth so that you can focus on the

things that matter to you

Take Control of Your Financial Future

Work with our team of advisors to manage

your wealth so that you can focus on the

things that matter to you