Matt Shibata

As the post-IPO lockup period of Reddit expires this week, it is a good time to revisit a common question that we get from clients: “Now that I am able to sell shares, how should I sell them?”

One of the issues that early employees of public companies may have is wanting to sell more stock than the market can support. This is typically not an issue for companies that go public with large market capitalizations in the tens of billions of dollars, but many companies (such as Reddit) go public with market caps below $5B or $10B (and these are considered small-cap or mid-cap stocks).

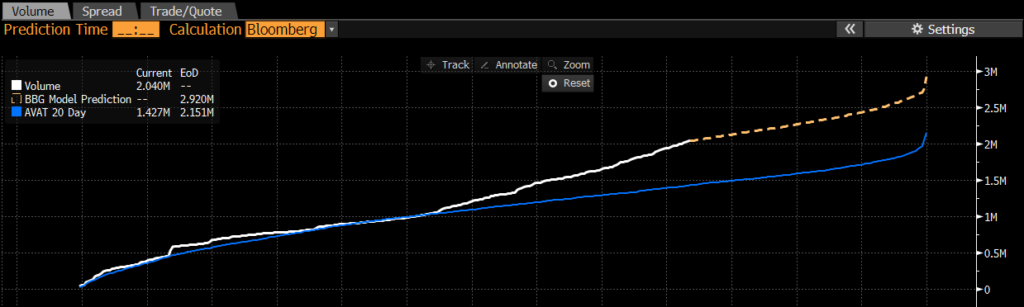

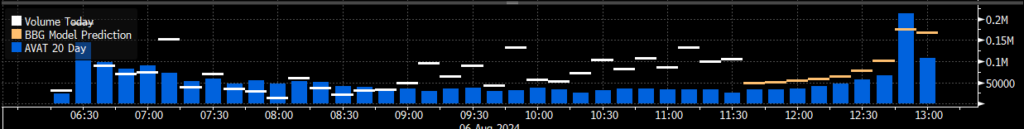

Consider the case of Reddit, where the 20-day average volume is just over 2 million shares/per day (as indicated by the blue line in the below chart). In today’s (8/6/2024) trading, the volume is trending a bit higher than the recent average (as indicated by the white line). The trade volume on any given day will always be above or below the average, but it is something to be aware of.

Source: Bloomberg

A Reddit employee attempting to sell a few hundred shares (or even a few thousand shares) probably won’t have any problem submitting market orders online. As the below order book shows, there are over 300 shares at the best bid price and nearly 2,000 shares at the best ask price (and there is probably a lot more liquidity than what is shown too).

Source: Bloomberg

The above charts are simplistic indicators, but illustrate the point that a Reddit employee could easily sell a small number of shares with no issue. However, what about the Reddit employee who wants to sell 200,000 shares? 200,000 is 10% of the average DAILY volume! Just knowledge of that order would drive the RDDT price down. Looking at the below graph, we can see that less than 100,000 shares are sold in most 10-minute periods (much less 1-minute or 1-second periods!).

Source: Bloomberg

In these cases, the Reddit employee/shareholder has a few options:

- Once the lockup period is over, a Reddit employee could enter a sell order online. However, this could be risky if the trade size is a material fraction of the daily trade volume or overwhelms the available liquidity. Entering a market order for 10% of the daily volume could crash the price. A limit order near the bid would barely get filled too, at that size. Hypothetically, the seller could sit there and enter a lot of small orders over time, although that could be onerous too (imagine submitting 2,000 trades of 100 shares to sell 200,000 shares!).

In these situations, we typically recommend working with a trade desk. We do this on behalf of many of our clients, but are happy to guide clients through the process if the assets are not on our platform. In the case of Reddit, employee stock is held at Shareworks, a platform at Morgan Stanley. So, Reddit employees could call Shareworks and ask for the trade desk. Below are a few common courses of action.

- Reddit employees could ask the trader for a “bid” (or “risk bid”) for the entire order. Rather than offering the stock on the open market or sell it down over time, the trader can see what price other traders would be willing to buy the entire amount at. So, rather than selling some shares at $55 and some at $54 (and some at $53 and so on), there might be a buyer willing to take all of the shares for $53.57 (just as an example). The bid may or may not end up being the best price, but the trade can be done quickly and may reduce the risk that knowledge of a large sale gets out (and pushes the price down).

- Another option available to Reddit employees selling stock after the lockup ends is to use an algorithm (algo) to trade. As an example, Reddit employees could ask the trader to put the trade in a VWAP (volume-weighted average price) algo, where the order will be broken up into many small trades throughout the day with the goal of matching the stock’s VWAP. Typically, the algo will sell more when volume is high and less when volume is lower. Other variations are TWAP (time-weighted average price), POV (percentage of volume), and so on.

- Lastly, Reddit shareholders could ask the trader to simply pursue a traditional market or limit order strategy, but just break the order up into many smaller trades to minimize the price impact of trading.

Whether the stock is Reddit or another one, shareholders should review how much stock they want to sell (relative to expected volume/liquidity of that stock) and consider working with a trade desk if warranted.

Post Note: For those interested in thinking through how much to sell and/or the considerations that go into that, check out our recent webcast.