Tax Document Resources

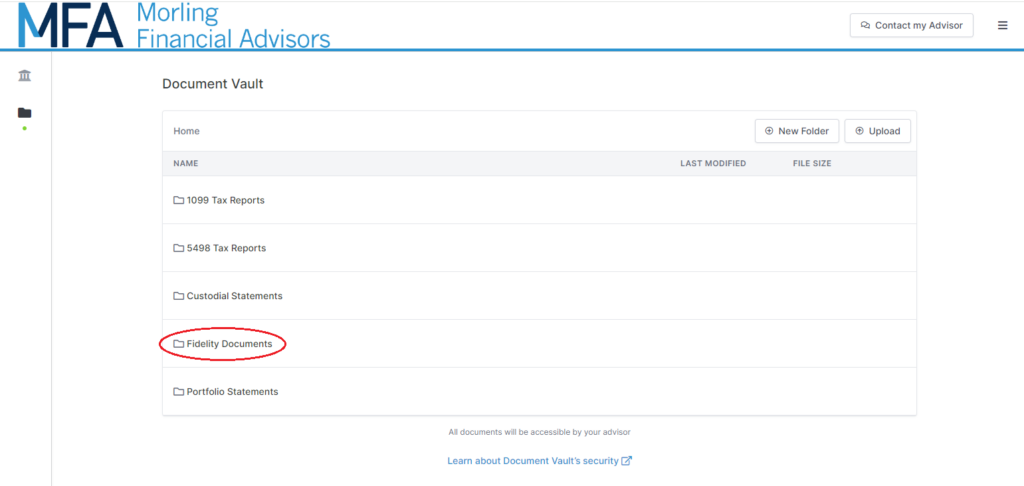

Tax documents can be found in the folder section of MFA’s client portal. Once you have logged in, click the folder icon on the left-hand side of the screen.

- Tax documents from Schwab can be found in the “1099 Tax Reports” folder.

- Tax documents from Fidelity can be found in the “Fidelity Documents” folder.

- Schwab is posting some 1099’s electronically, but not all (so it is important for you and/or your tax preparer to review and confirm that you have all of your tax documents before filing).

- Tax documents from Fidelity can be found within the “Fidelity Documents folder” (see second image below).

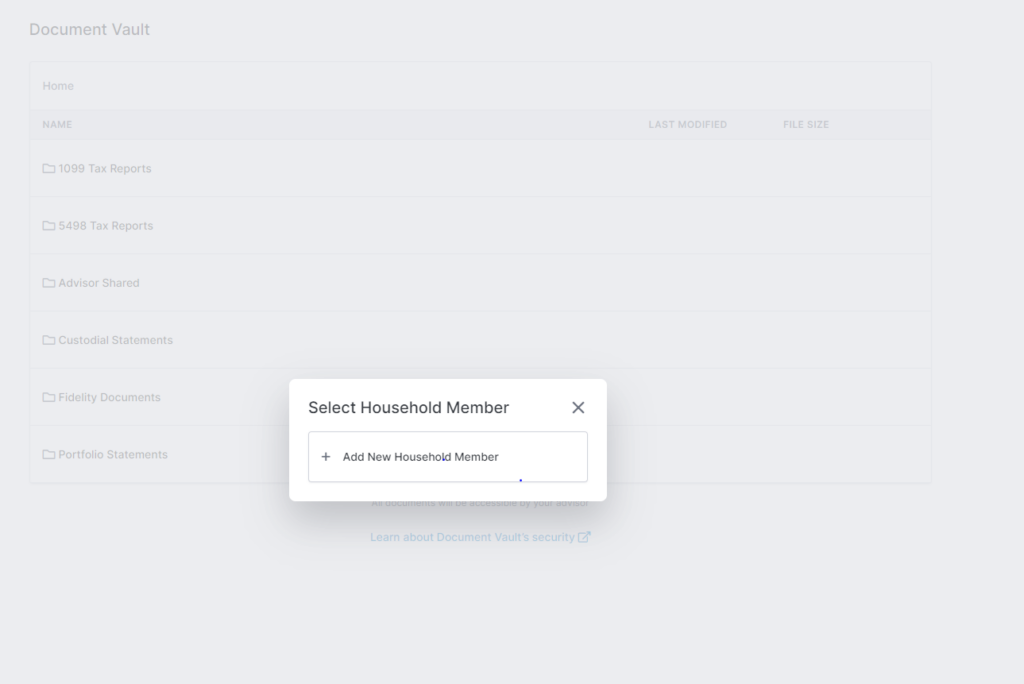

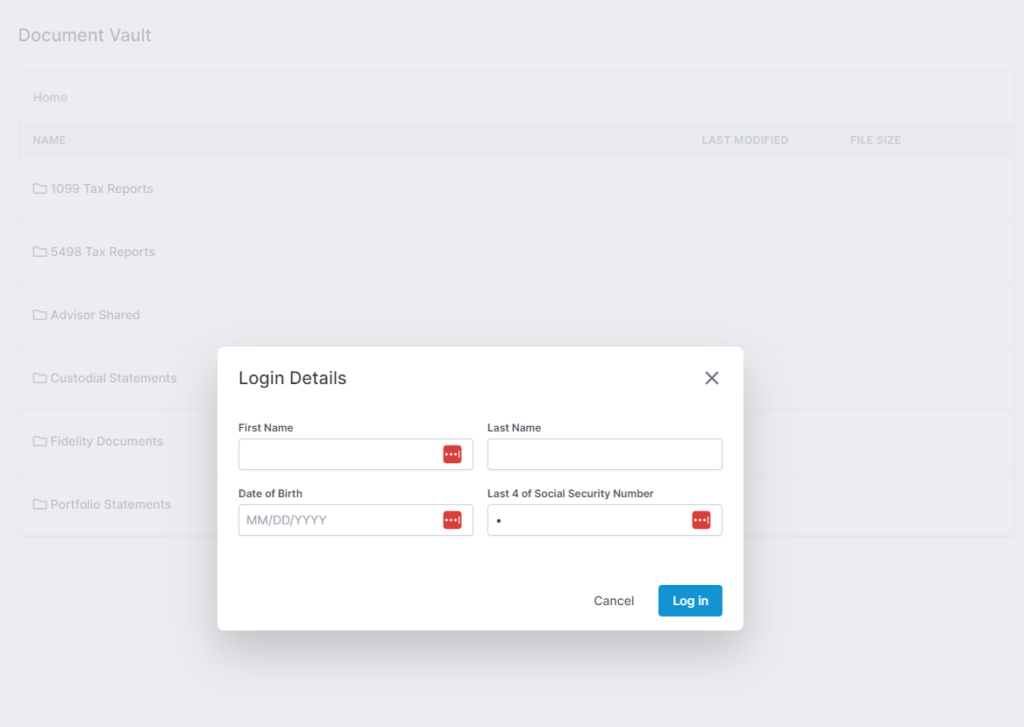

- When the client (or accountant) opens the Fidelity folder for the first time, they will be prompted to enter account holder name, DOB and last four of SSN. Using either account holder or trustee’s name should work (unless a married couple has individual accounts, in which case details of each should be provided).

- Tax documents (such as K-1s and 1099s) from private funds can be found in the Advisor Shared folder.

Please reach out to your advisor or the service team with any questions whatsoever.

To find Fidelity documents, locate the Fidelity Documents folder.

You will be prompted to enter personal information in order to establish folder access the first time you login.

__________________________________________

__________________________________________